The world of blockchain is a story of constant innovation and trade-offs. Early blockchains like Bitcoin and Ethereum achieved something remarkable: unprecedented security and decentralization. But as they grew in popularity, they began to face a familiar trio of challenges: slow transaction speeds, high fees, and limited scalability. You can’t build a global financial system if it costs a small fortune and takes ten minutes to buy a cup of coffee.

This is where scaling solutions enter the picture. Among the most important and practical of these are blockchain sidechains, a crucial piece of layer 2 tech designed to help blockchains evolve without compromising their core values. But what exactly are they, and how do they solve these pressing issues?

Also Read: CEX vs DEX: Which Crypto Exchange Is Right for You?

The Blockchain Trilemma: The Need for Scale

To understand sidechains, we must first acknowledge the “blockchain trilemma.” This concept suggests that it’s incredibly difficult for a single network to perfectly achieve all three of these properties at once:

- Decentralization: No single entity controls the network.

- Security: The network is resistant to attacks.

- Scalability: The network can handle a high volume of transactions quickly and cheaply.

Mainnet blockchains often prioritize decentralization and security, leaving scalability as the bottleneck. Sidechains are a direct response to this problem, offering a path to scale by operating alongside the main chain.

Also Read: Crypto Wallets: Hot vs Cold Storage Comparison

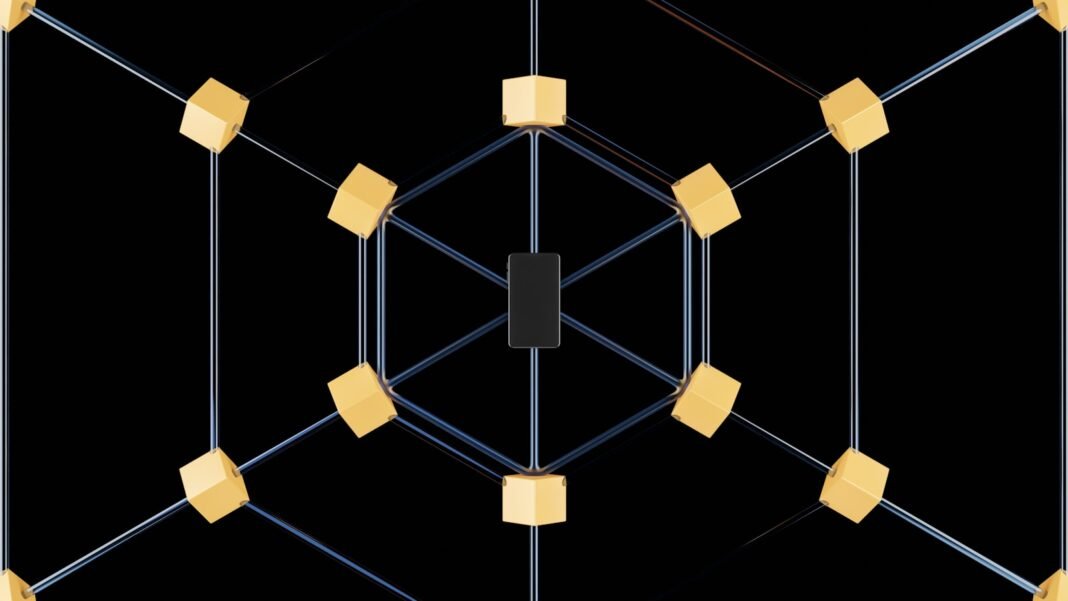

What is a Sidechain? A Parallel Highway

A sidechain is an independent blockchain that runs parallel to a mainchain (like Ethereum or Bitcoin) and is connected to it by a two-way bridge. Think of it not as a new layer on top, but as a separate, purpose-built highway running alongside the congested main road. Vehicles (assets and data) can move freely between the main highway and the side road via designated on and off-ramps (the bridges).

The key characteristic of a sidechain is its sovereignty. It has its own consensus mechanism (like Proof of Authority or a different Proof of Stake variant), its own block parameters, and its own security model. This independence allows it to be highly optimized for specific use cases, such as blazing fast transactions or complex private smart contracts, that would be inefficient or impossible on the mainnet.

Also Read: How to Buy Bitcoin: Step‑by‑Step Tutorial

How Do Sidechains Actually Work? The Bridge Protocol

The magic of a sidechain lies in its secure connection to the main chain. This is managed through a two-way peg system. Here’s a simplified breakdown of the process:

- Locking Assets: Imagine you want to move some ETH from the Ethereum Mainnet to a sidechain like Polygon POS. You first send your ETH to a specific smart contract on the mainnet. This contract acts as a vault, locking your funds securely.

- Confirming and Relaying: Once the transaction is confirmed on the mainnet, this information is relayed to the sidechain network.

- Minting Representative Assets: After verifying the lock-up, the sidechain mints an equivalent amount of “wrapped” or representative tokens (e.g., WETH on Polygon) and deposits them into your wallet on the sidechain. These tokens are your key to interacting on the new chain.

- Returning to Mainnet: The process is reversed to bring assets back. You burn the wrapped tokens on the sidechain, and a message is sent to the mainnet contract, which then releases your original ETH back to your wallet.

This entire mechanism is trust-minimized and automated by smart contracts, ensuring that assets are always backed 1:1 by their locked counterparts.

Also Read: How to Buy Ethereum: The Complete Beginner’s Guide

Why Use a Sidechain? The Compelling Advantages

The decision to use a sidechain is driven by a need for practical performance today. The advantages are transformative for users and developers alike.

For Users:

- Drastically Lower Fees: By moving transactions off the congested mainnet, sidechains reduce fees to a tiny fraction of the cost.

- Lightning-Fast Speeds: With optimized consensus and dedicated capacity, sidechains can process transactions in seconds, not minutes.

- Access to New Applications: Many innovative dApps choose to build exclusively on sidechains to offer a better user experience.

For Developers:

- Experimentation and Flexibility: Developers can experiment with new virtual machines, governance models, and privacy features without needing consensus to change the mainnet.

- Scalability for dApps: Applications that require high throughput, such as blockchain games, decentralized exchanges, and NFT marketplaces, can function smoothly without being crippled by mainnet gas wars.

- A Path to Mainnet: A sidechain can serve as a testing ground for new ideas that might eventually be incorporated into the main chain’s development.

The Trade-Offs: What Are the Risks?

No technology is perfect, and sidechains come with their own set of compromises. The primary trade-off is in the security model.

Because a sidechain has its own consensus mechanism, it is responsible for its own security. A smaller sidechain with fewer validators could be more vulnerable to a 51% attack than the massive, established mainnet it connects to. The security of your assets on a sidechain is only as strong as the sidechain itself. This is a key differentiator from other layer 2 tech like rollups, which inherit security directly from the mainnet.

Therefore, users must choose well-established, reputable sidechains with robust and decentralized validator sets.

Also Read: How to Pick the Right Crypto Exchange & Trading Platform

Sidechains in the Wild: Real-World Examples

The theory is compelling, but sidechains are already delivering value today.

- Polygon POS: One of the most prominent Ethereum sidechains, it has become a hub for DeFi and gaming, offering fast and cheap transactions while maintaining a strong bridge to Ethereum.

- Gnosis Chain (formerly xDai): A stablecoin sidechain that uses the stablecoin DAI as its native token, making it ideal for payments and applications requiring price stability.

- Liquid Network: A Bitcoin sidechain built for faster trading and settlement of Bitcoin and the issuance of digital assets like stablecoins.

The Future is Multi-Chain

Sidechains are not a silver bullet, but they are a vital and practical piece of the blockchain scaling puzzle. They represent a pragmatic approach to innovation, allowing for experimentation and scalability without forcing the entire ecosystem to agree on a single path forward.

As the blockchain space continues to mature, the future looks less like a single dominant chain and more like an interconnected ecosystem of mainnets, sidechains, and other layer 2 tech, all working in concert. They form a mosaic of specialized networks, each designed for a specific purpose, yet all seamlessly connected. By understanding and utilizing sidechains, users and developers can access the best of all worlds: the ironclad security of mainnets and the high performance of specialized chains.