The freelance economy is built on freedom and flexibility, but traditional payment systems often lag. Waiting days for bank transfers, dealing with high transaction fees, and navigating complex international wire transfers can disrupt a freelancer’s cash flow and efficiency. A growing number of independent professionals are now turning to a modern solution: cryptocurrency. Using crypto for freelancers is not just a trend; it is a practical strategy to streamline finances, reduce costs, and access a global client base without traditional banking hurdles.

Adopting crypto payments may seem technical at first, but the core principles are straightforward. It involves selecting the right digital currencies, leveraging specific crypto payment tools, and understanding the simple workflow to receive payment from a client. This approach can fundamentally transform how you manage your business income.

Also Read: How to Buy Ethereum: The Complete Beginner’s Guide

The Compelling Advantages of Crypto Payments

Why would a freelancer choose to be paid in cryptocurrency? The benefits are tangible and directly address common pain points. The most significant advantage is the dramatic reduction in fees. Traditional payment processors and international wire transfers can take a substantial percentage of your hard-earned income. Crypto transactions, in contrast, typically involve minimal network fees, especially on certain blockchains, ensuring you keep more of what you earn.

Speed is another critical factor. Instead of waiting three to five business days for a bank transfer to clear, a cryptocurrency payment can be settled in minutes, regardless of the geographical location of you or your client. This instant access to funds improves cash flow and provides immediate financial flexibility. Furthermore, crypto payments offer a level of financial access that is unparalleled. If you have a client in a region with limited banking infrastructure or complex cross-border payment rules, cryptocurrency provides a seamless alternative. All that is required is an internet connection and a digital wallet, democratizing access to the global talent market.

Also Read: CEX vs DEX: Which Crypto Exchange Is Right for You?

Setting Up Your Freelance Crypto Operation

Getting started is a methodical process that begins with education and setup. Before receiving any payment, it is crucial to have a foundational understanding of the ecosystem. You do not need to be an expert trader, but knowing how blockchain transactions work, the importance of private keys, and the difference between various coins will make you more confident and secure.

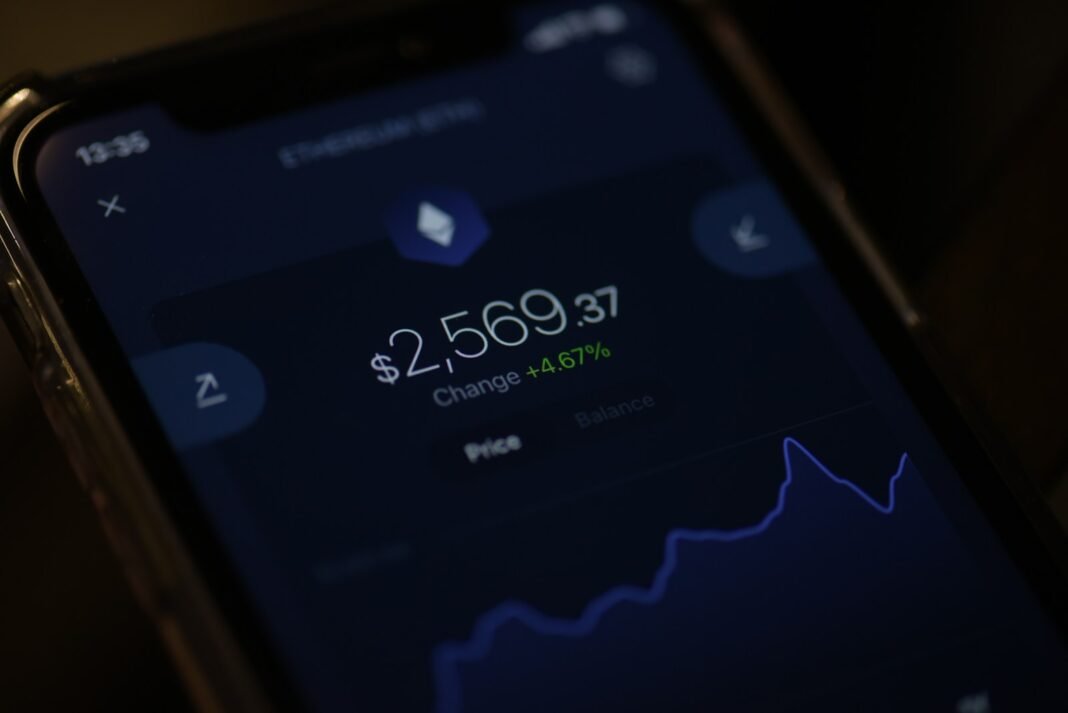

The first practical step is choosing a cryptocurrency wallet. This is your personal digital bank account where you will store your crypto assets. For security, a non-custodial wallet, where you control the private keys, is often recommended for storing larger amounts. For smaller, more frequent transactions, a custodial wallet provided by a major exchange might offer convenience. The next step is selecting which cryptocurrencies to accept. It is wise to start with established, stable coins to minimize volatility risk. Many freelancers begin with stablecoins, which are pegged to a stable asset like the US dollar or major cryptocurrencies like Bitcoin or Ethereum, due to their widespread acceptance and liquidity.

Also Read: Crypto Wallets: Hot vs Cold Storage Comparison

The Practical Workflow and Essential Tools

Once you are set up, the process of receiving payment is simple. You provide your client with your public wallet address, a long string of letters and numbers, or a QR code they can scan. They then initiate the transfer from their wallet to yours. You can then track the transaction on a blockchain explorer, a public ledger that shows the status of the payment in real time.

To make this process even smoother, several crypto payment tools are designed specifically for businesses and freelancers. These platforms can help you generate professional invoices priced in your local currency but payable in crypto, automatically managing the conversion for your client. They act as a bridge, simplifying the experience for those who may be less familiar with digital currencies. Some tools even allow for the immediate conversion of crypto to fiat currency upon receipt, effectively eliminating any exposure to price volatility if that is a concern for you.

When integrating crypto into your freelance business, a proactive approach to security and communication is vital. Always double-check wallet addresses before sending or receiving funds, as transactions are irreversible. Keep your private keys secure and offline, never sharing them with anyone. Furthermore, be prepared to educate your clients. Many may be curious but hesitant. Having a clear explanation of the process and the mutual benefits can ease their concerns and open the door to a more efficient payment relationship.

Embracing crypto for freelancers is about taking control of your financial workflow. By understanding the basics, selecting the right crypto payment tools, and prioritizing security, you can unlock faster, cheaper, and more borderless payments, allowing you to focus on what you do best: delivering exceptional work to your clients.